Good Eggs Sold To GrubMarket

Sources indicate the B2B software company is already making changes

According to sources, GrubMarket, a software provider and distributor has acquired e-commerce retailer Good Eggs. While this move could expand GrubMarket’s B2C offerings, especially given its produce-focused approach, the impact on the many small brands sold on Good Eggs remains uncertain.

Although the deal's terms were not disclosed, Several Good Eggs employees have reportedly been dismissed as part of the ownership transition.

While an employee indicated on LinkedIn that the agreement was signed at the end of July, the actual timeline still is a bit unclear. When reached yesterday, GrubMarket executives told me that the deal had not yet closed, and Good Eggs might still be entertaining offers from other companies. Today, however, executives confirmed the deal was now official.

Good Eggs did not respond to a request for comment.

The Good Eggs Roller Coaster

This news follows a tumultuous journey for Good Eggs. Founded in 2011, Good Eggs initially focused on essentially operating as a middleman to connect food producers and growers with their local customers. After early success in the Bay Area, the company raised $8.5 million and expanded to New Orleans, Los Angeles, and New York. However, that rapid expansion proved problematic, nearly leading to bankruptcy in 2015. Retrenching, the board brought in then-CEO Bentley Hall, a former executive at Plum Organics and Clif Bar, who scaled the company back to its original market.

Hall led Good Eggs through a recovery, overseeing its entry into prepared meals, meal kits, and alcohol, along with the development of a second warehouse in Oakland. While growth was gradual, the Covid-19 pandemic—and the resulting surge in online grocery shopping—seemed to encourage the company to accelerate its efforts.

In 2021, Good Eggs announced it had raised an additional $100 million (bringing total funding to over $170 million) from investors including Glade Brook Capital Partners, GV (Google Ventures), Tao Capital Partners, Finistere Ventures, Benchmark Partners, S2G, and Obvious Ventures. The retailer then expanded into Southern California and launched a national gifting platform at the end of 2022.

However, the sales boom slowed as shoppers returned to physical stores. Good Eggs reportedly saw sales drop from $106 million in 2021 to $86 million in 2022, all while continuing to report negative profit margins and high cash burn. Reports from last year indicate that the company’s valuation, which was $270 million in 2020, plummeted by over 90% to $15 million in 2023, during a $7 million funding round needed to keep the company afloat.

GrubMarket’s Acquisition Fueled Growth Strategy

Meanwhile, ten-year-old software and services company Grubmarket, has undergone its own metamorphosis. Founded in 2014, the company also began with a direct-to-consumer bent.

However, that strategy has shifted in recent years to a B2B focus, with Grubmarket gobbling up over 70 distributors and wholesalers. In 2024 alone the provider has acquired produce companies including Oriental Produce, Brother’s Produce, Global Produce, Performance Produce andJC Cheyne, as well as software makers Parsemony and Butter. The company’s most recent press release describes itself as “the first-mover in tech-enabled B2B food eCommerce.”

It’s revenue streams now include:

Software offerings for food wholesalers, distributors, and brokers that include everything from analytics platforms, to payment processing tool to e-commerce storefronts, inventory management and HR and accounting

A network of wholesalers and distributors, some of which have direct and/or exclusive relationships with farmers.

Online produce delivery services for shoppers and offices

Interestingly, the software piece of the business harkens back to how Good Eggs initially began, processing orders for small producers and streamlining delivery processes.

With over $560 million in capital raised, GrubMarket sports a $3.5 billion valuation. While the company said in 2021 that it would IPO within the next 11 months, that goal has yet to come to fruition. Still, while the company has said it’s achieved profitability and seen continued sales growth, my question is how much of the latter has simply come from adding to its bullpen of companies.

What Does this Mean for Brands?

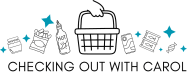

Aside from a B2B focus, GrubMarket also differs from Good Eggs with its assortment, focusing on produce and perishable goods. Good Eggs, meanwhile, has always tried to offer a more complete shop, with center store, deli, and prepared food offerings.

According to a former employee, the company was in the process of optimizing its fulfillment centers in order to grow from 6,000 SKUS to 10,000.

So like the demise of Foxtrot (at least temporarily), will this remove yet another retail testing ground for emerging brands? While Good Eggs has broadened its assortment to include larger brands and even KeHe’s private label Cadia products, it still has continued to stock indie brands such as Lexington Bakes, Dalci, and Alice Mushrooms.

Stay tuned to hear more about GrubMarket’s plan for the company…does this mean a return to B2C?