Better Brand Lives?; Nuggs Sells; Real Talk about Siete

Plus Exec Changes at Liquid Death & Lemon Perfect; The Fast Casual Chain Expanding into CPG

Well hello there everyone! After working on some exciting consulting projects, I’m back from Italy, where I had the pleasure of meeting with and being hosted by amazing food and wine producers. I’ll share more once I’ve adjusted to the time zone (and digested all the pasta!), but for now, let’s dive into the news

Ways to Help Hurricane Victims

While the Siete deal has taken over LinkedIn, Instagram, and TikTok, let’s not forget Helene and the soon-to-come-ashore Milton.

I know it’s crunch time with Q4 and 2025 planning, so I’ll make this easy: check out The Frontline Impact Project, a nonprofit started by KIND founder Daniel Lubetzky. Originally created during the pandemic, the organization matches corporate CPG donors with hospitals, educators, and disaster relief organizations seeking assistance. Their goal is “to make product donations easier for CPG companies.” See, easy.

Right now, they’re focused on collecting non-perishable food, hygiene items, and first aid supplies for communities in Western North Carolina but they will also be supporting Florida residents impacted by Hurricane Milton.

If you’re interested (and you should be!!), all you have to do is reach out here to set up a donation. Coming from New Orleans and having experienced Katrina, I know how much this support matters.

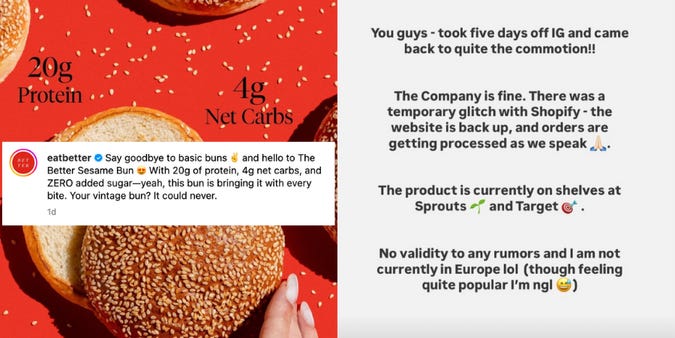

Is Better Brand Still Alive?

The CPG rumor mill has been buzzing about Better Brand, the low-carb, high-protein baked goods provider. Social media is filled with customers claiming they've been charged for products that never shipped, and the company's website was down briefly last week, adding fuel to the fire.

But just yesterday, their Instagram account posted about their Better Sesame Bun, and the website is back up and running, taking orders. Founder Aimee Yang reassured her own followers that it was just a technical glitch, the company is fine, and orders are being processed.

However, some customers report receiving emails from Better Brand’s customer service team stating the company is fighting off a “hostile takeover event by large institutions.” Stay tuned!

Let’s Talk Siete

Now, let’s circle back to the tortilla chip in the room.

By now, you’ve heard that snack and beverage giant PepsiCo has acquired Mexican-American food brand Siete Foods. If this is the exit Siete hoped for, I’m thrilled—they're one of the most genuine, hardworking teams in the industry. But amidst the celebration, here are a few key takeaways.

Products and Platforming

Many speculate that Pepsi admired Siete’s “platform” potential, but I believe Pepsi’s interest lies more in snacks—and maybe dips. That’s where Pepsi can flex its distribution muscles and scale quickly. Categories like canned beans and frozen tortillas? Not likely the crown jewels here. Though Siete’s sprouted bean dips and vegan queso didn’t stick and were discontinued, Pepsi could revive that space – albeit perhaps with a slightly less BFY bent. Seasonings, in my opinion, are an easy cut with a lack of product differentiation and slow turns in the category.

Siete also made a smart move by evolving beyond the natural foods crowd. Starting with grain-free tortilla chips, they expanded to more intensely flavored chips that could go toe-to-toe with Doritos. And, most recently, the brand ventured into kettle chips with even more mainstream flavors like salt and vinegar.

These strategic snack moves likely got Pepsi’s attention— Siete wasn’t just playing defense; they were offering real competition. The chips, in particular, were a credible share threat to Pepsi’s existing brands and not a product format that Pepsi could (authentically) create on their own.

Smart Money

When it comes to exits, things aren’t always as straightforward as they seem. While headlines often focus on the big payout, the actual returns for founders and early investors can vary depending on how the deal is structured and the company’s cap table (i.e., the breakdown of company ownership and who gets paid what with an exit).

Siete only raised a minority investment of $90 million in 2019 from Stripes Group – which means their cap table may not have been as diluted as it could have been with multiple rounds of funding.

The Garza family likely came out well in this deal, but it’s important to remember that not every founder is guaranteed a huge windfall from an acquisition. The timing of when you raise capital, who you raise it from, and how your equity is structured can significantly influence how much you benefit from an exit. Founders who don't pay attention to these details can be surprised by how little they personally make from a big acquisition, even if their company sells for a hefty sum.

Tempering Future Expectations

$1.2 billion dollars is certainly impressive, but let’s compare it to other recent snack food exits. **note: I’m using data (and the wording) that has previously been shared **

Quest (2019): Estimated 2019 net sales of $345M; acquired for $1 billion (2.9x sales)

Perfect Snacks (2019): $70M in net revenue; acquired for $284M (4.1x net revenue)

KIND (2020): Sales of $1.5B annually; acquired for $5 billion (3.33x sales)

Lilly’s (2021): More than $110M in sales in 2020; acquired for $425M (3.9x sales)

Dot’s Pretzels/Pretzels Inc (2021): $275M in aggregate net sales for the trailing 12 months; acquired for $1.2 billion (4.36x net sales)

Clif (2022): $800M in sales; acquired for $2.9 billion (3.6x sales)

Siete: Estimated 2024 sales of 500M ; acquired for $1.2 billion (2.4x sales)

While these numbers don’t account for all factors in valuation, one thing is clear: This deal is solid, but let’s not jump to conclusions about a return to high valuations. 2020 it is not.

Wicked Chicken

Just a few months after announcing the acquisition of plant-based food brand Wicked Kitchen and the licensing rights to Good Catch, newly formed holding company Ahimsa Companies has also acquired faux chicken producer Simulate (formerly known as Nuggs).

Nuggs was part of the wave of “it’s not a food brand, it’s a tech company that makes food” over the past few years, even incorporating V1 and V2 into its product names. Its financial backing from tech investors reflected that strategy, raising over $60 million and, at one point, achieving a valuation of $260 million, according to TechCrunch.

However, the company's status has become murky in recent months. The product locator returned zero hits, regardless of the city I searched, and Simulate has been notably quiet on Instagram. It's unclear if the brand’s “Insta-Chicken,” a microwavable chicken breast-like product launched earlier this year, ever made it to market.

Ahimsa aims to consolidate plant-based food companies, leveraging economies of scale and improving efficiencies to help these brands achieve financial success and stability. The plant-based food market has faced significant challenges in recent years, to say the least. While others have attempted to create similar alt-meat conglomerates, Ahimsa believes it will succeed where others have not. The company has also purchased an alt-meat plant in Ohio (likely the old Gathered Foods production facility) and stated that owning a complete supply chain will benefit its portfolio companies.

Read up on Ahimsa’s strategy moving forward.

1-800-Flowers says Scharffen Berger Pickup Can Add $50M-$100M in Revenue

In August, craft chocolate brand Scharffen Berger changed hands yet again, selling to online gifting platform 1-800-Flowers. While executives were initially tight-lipped about their plans, the company’s recent quarterly earnings call has provided clarity. (For a quick history lesson on the companies and deal, get up to speed here.)

Deal Details

On the earnings call, 1-800-Flowers founder and CEO James Francis McCann shared that he had considered acquiring Scharffen Berger 15 years ago, but “another company beat [him] to the punch.”

With the brand generating only “[a] couple of million dollars” at the time of purchase, McCann described the deal as “low risk.”

McCann noted that the deal was similar to a prior acquisition, as it included only the intellectual property, the brand URL, a database of past customers, and a few staff members.

The Opportunity

1-800-Flowers has a clear and capital-efficient path to growing Scharffen Berger's sales, McCann said, by leveraging existing marketing campaigns, adding products to gift baskets, and exposing them to the company’s existing “huge customer base.”

While these efforts alone will “double or triple” top-line sales, McCann pointed out that “that level of growth is inconsequential when you think about our size.” In the next five years, 1-800-Flowers believes it can grow the business to $50-$100 million.

The Unknowns

Production: McCann noted that while Scharffen Berger has “a good facility,” it’s not equipped to handle larger volumes. Instead, 1-800-Flowers plans to utilize its own production facilities, requiring “no additional capital cost.” So, was the Scharffen Berger plant even part of the deal? If not, who bought it?

Product: McCann repeatedly highlighted Scharffen Berger’s craft appeal and giftable nature. This raises concerns about the brand’s future presence in brick-and-mortar stores with its lower-priced Break’s line.

Brand Proposition and Positioning: The Scharffen Berger website already redirects to Harry and David, and all social channels appear to have gone silent. How much brand presence does 1-800-Flowers truly want to maintain? Without it, does a Scharffen Berger product hold the same cachet with shoppers?

News Bites:

Chilly News: Just when you thought your LinkedIn feed had peaked on cold plunge content… Wellness club Remedy Place has partnered with Kohler to create a new ice bath. With a price tag of a cool $15,000, the tub can be installed indoors or outdoors and includes a “breath light aid.”

On the Move:

Oats Overnight Chief Strategy Officer Nina McKinney is stepping into the newly created role of Chief Business Officer. Founder and CEO Brian Tate commented on LinkedIn that McKinney was “born to operate.”

Lemon Perfect has a new top executive, with founder Yanni Hufnagel taking on the role of executive chairman and former spirits exec Jeff Popkin stepping in as CEO. Meanwhile, president Jim Brennan has also departed the company.

Marisa Bertha (the only person I’ve seen navigate a trade show in heels) has been promoted to Chief Strategy Officer at water brand Liquid Death.

Kegan Simons is keeping things spicy, transitioning from director of sales at Fly by Jing to VP of sales at Zab’s.

After stepping away from running snack brand IWON, Mark Samuel will now lead Unbun. Let’s hope his busy schedule still allows him time to post on LinkedIn ;)

Distribution Wins:

Snack brand Rolling Pin Snacks has launched a 28 oz bag of its Crunchy Corn in five new Costco regions.

Four years after being discontinued at Kroger due to a branding transition, Deep Indian Foods is back in the retailer’s freezer set. Kudos to GM Kiernan Laughlin for the awesome (and honest) LinkedIn post detailing the news.

Bean-based meal-on-the-go brand Lentiful can now be found in all Wegmans locations, where the heat-and-eat cups are intriguingly stocked alongside the mac and cheese section.

New Plant(ish)-Based Player: Tom Lynch, a former Beyond Meat product developer, has co-founded food tech company Asentia alongside former Mission Barns team member Parendi Birdie. Rather than following the alt-meat herd, Asentia aims to “simply make meat better” by using plants to enhance meat instead of entirely replacing it. Products listed on its LinkedIn page include truffle mushroom meatballs, bourbon bacon artichoke sausages, and black Angus roast shallot and shiitake burgers.

Misfits Looks to Add Members: After a successful summer test, online grocery retailer Misfits Market is officially launching its loyalty program, Misfits+. For a $69 annual fee, shoppers receive exclusive discounts and reduced shipping costs. One claim that caught my eye is that “your Misfits+ annual fee pays for itself with just one order per month.” How is that possible, you might ask? According to the Misfits+ page, customers generally save more than $69 when comparing Misfits+ products to standard MSRP or other grocery prices. Hmmm. I’ll watch to see how that one lands with shoppers.

Add to Cart: New Products On Shelf

If you’re chronically online, you’ve probably seen a creator or two sharing their love for Buldak’s instant Carbonara ramen. Building on that success, parent company Samyang Foods is bringing its Buldak Carbonara Dumplings in the U.S. To heat things up further, the South Korea-based company will also offer 50-count packs of its Buldak Hot Sauce packets.

After testing value-added products like smoothie bowls and sorbet, Pitaya Foods has launched a new line of smoothie pops. Unlike other Pitaya products which are available on the brand’s website, these pops are exclusive to Walmart. The pops are currently sold in the frozen fruit section and I’ll be watching to see if their positioning evolves with greater distribution. I see a solid opportunity in selling these pops in the novelty section, where their cardboard “squeeze pop” format could make them a standout BFY option against brands like Popsicle and Icee.

Fast casual restaurant chain Tatte is venturing into CPG with a two-SKU line of coffee beans. Available only in cafes, the coffees are produced in partnership with Massachusetts-based roasters George Howell Coffee and Gracenote Coffee. With 40 locations across the DC and metro-Boston areas, Tatte appears to be on an expansion tear. In my suburban town alone, we’ve gone from zero locations to three cafes within a four-mile radius in the last year.

Breakfast brand Belgian Boys has rolled out two Breakfast All Day and three Pancakes-to-Go kits. This seems like a smart move, putting the brand in a new section of the store and opening channels like c-stores, while also offering a fresh way to drive trial. Remember, think like your acquirer! In recent years, Belgian Boys has pivoted successfully from cookies (where IMO they had a less defensible position compared to other imported cookies) to refrigerated breakfast items.

Chikka Chikka is capitalizing on the digestive health trend with a new line of fennel seed snacks inspired by the South Asian treat Mukhwas. Packaged in pocket-sized tins, these snacks combine fennel seeds with functional ingredients that freshen breath, support digestion, reduce inflammation, and provide a boost of fiber and minerals. While consumer education will be essential for success, the brand deserves credit for introducing functionality, a limited ingredient deck, and global flavors to the breath mint market. I can easily see this taking off at Erewhon.

Speed Round:

Just in time for the holidays, snack brand Snoods is launching limited-edition Sweet Kugel noodle chips. It's great to see brands introducing sweet flavors to typically savory formats—think Siete’s buñuelos and You Need This’ Churro Puffs.

Nespresso is debuting its first RTD: Master Origins Colombia coffee sweetened with honey. Despite its steep price of $66 for 12 cans (7.6 oz each), it’s already sold out online.

Water and coffee bean producer WAIĀKEA is combining its existing product lines with a new bag-in-box cold brew coffee. The brand claims that consumers can drink the coffee as is or use it as a concentrate.