Beer, Booze, Cannabis… and Crackers? Why Tilray Is Expanding Beyond Hemp

Get ready for more deals to come.....

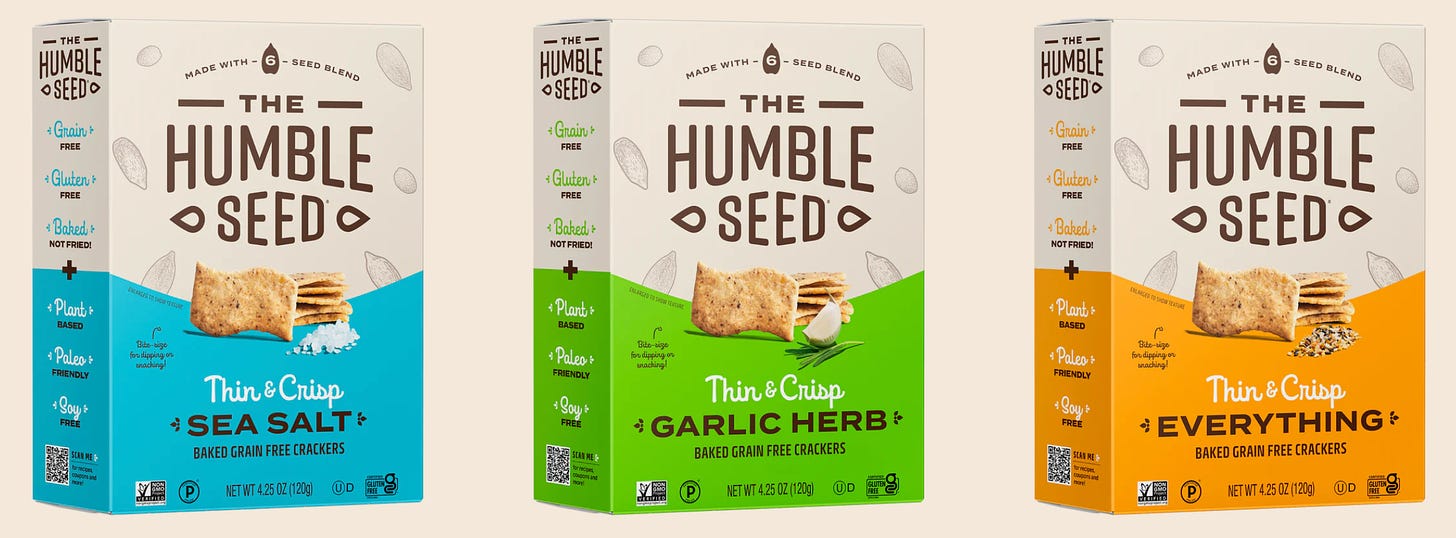

After acquiring eight craft beer brands from Anheuser-Busch last summer, Tilray has turned its attention to the snack aisle, recently announcing the purchase of the cracker brand Humble Seed. While seed crackers might not seem like a natural fit in a portfolio that includes Redhook Brewery, Manitoba Harvest, Breckenridge Distillery, and Chowie Wowie cannabis confections, Tilray is betting on snacking and wellness as the next frontier. And keep an eye out – this deal is just the beginning.

For those less familiar with Tilray, the company’s portfolio includes a fast-growing craft beer and spirits business, recreational cannabis in Canada, and medical cannabis in Australia and Europe. The wellness division, led by president Jared Simon, primarily revolves around Manitoba Harvest, but it’s also expanding with the relaunch of energy drink Hiball.

Similar to its entry into beer, Tilray significantly expanded its cannabis business in 2021 through a merger with Aphria. This merger brought in Irwin Simon, Aphria’s Chairman and CEO, who remained in the same roles at the now-larger Tilray. Simon, the founder and former CEO of natural foods and snack leader Hain Celestial, knows a thing or two about the snack business.

Following the merger, Jared Simon (no relation to Irwin Simon) noted that Tilray aimed to become a “CPG diversified cannabis company,” leveraging opportunities in related categories.

So, how’s that strategy playing out? In its most recent earnings call, Tilray reported net revenue of $229.9 million. However, the wellness division, with $15.7 million in sales, still lags behind the beverage-alcohol and cannabis segments, which brought in $76.7 million and $71.9 million, respectively. While the wellness division saw a 6% increase in net revenue, its growth remains modest. Despite ambitions to deepen its wellness reach, executives anticipate double-digit growth from cannabis and beer next year, while wellness is expected to see only low to mid-single-digit growth.

Given that wellness is a smaller slice of the business, why not focus where it's already making money? It boils down to Tilray’s need to expand in the American market. While it’s making inroads in beverages, cannabis and CBD sales in the U.S. have been hampered by slow-moving federal regulations.

Consumer confusion is also a challenge. Even with non-CBD products like Manitoba Harvest’s hemp hearts and hemp oil, many shoppers still associate hemp with cannabis, creating a unique hurdle for Tilray’s wellness ambitions.

“CBD actually, I think, set hemp foods back quite a bit because then there was all this confusion,” Simon said. “We've looked at our strategic plan with cannabis being where it is in terms of legislation and regulation..[and are looking for other acquisitions].”

So, though Manitoba has over a 53% market share in branded hemp products and plans to launch new snacking innovations later this year, the line can only go so far under the current constraints, Simon said. Seed-based products, however, offer the company a new revenue stream with far less consumer education.

“We are a hemp forward company, but we're not beholden to only doing hemp,” Simon said. “We have a lot of capabilities with our farming network, with our manufacturing facilities, with our distribution network to go beyond just being a hemp company…[Hemp] is our bread and butter, but there's a lot of nice adjacencies in the seed world.”

Which takes us back to Humble Seed. Manitoba plans to keep the Humble Seed name, expanding the portfolio to include other seed-based snacks that don’t necessarily contain hemp. Though the company considered launching a new brand itself, Simon said the pickup allows Tilray to jump straight into non-hemp snacking without investing in R&D.

While Simon declined to provide the purchase price, the deal included cash as well as further earnout potential for Humble Seed executives. The asset purchase included the brand’s IP, inventory, and branding, but not those of Humble Seed’s parent company Fourth World Foods, such as “certain relationships…[or] components with the corporate structure,” Simon said.

Humble Seed’s founding team, which includes CPG veterans Sarah Meis, Steve Shaffer, and Jennifer Mancusco, will not continue on with the company. Immediate next steps for Humble include expanding distribution beyond the brand’s current 2,000 door count as well as reducing costs, Simon said, as some retailers shied away from stocking the product due to its premium price point.

“We see an opportunity to really scale this brand at a different pace with a core set of products,” Simon said. “So while I'm anxious and excited about [future] innovation, these crackers right now, we want to get them in as many places as possible.”